Real Estate Investing Tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Get ready to dive into the world of real estate investing and discover key tips to help you navigate this lucrative market with finesse.

Introduction to Real Estate Investing

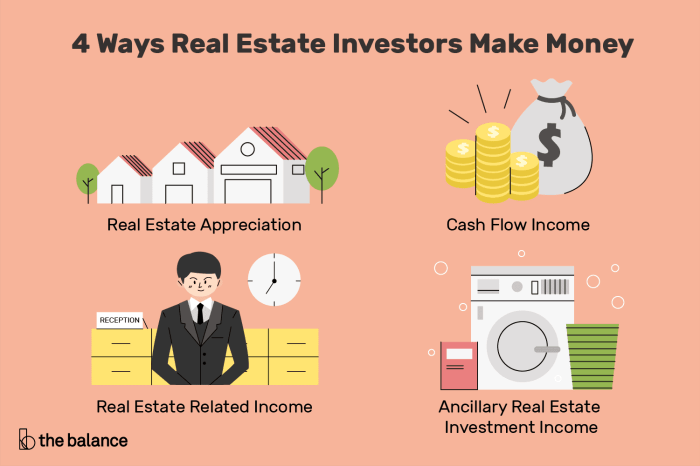

Real estate investing involves purchasing, owning, managing, renting, or selling real estate for profit. It is a popular form of investment due to its potential for long-term financial growth and stability.

Investing in real estate offers various benefits, such as:

– Potential for passive income through rental payments

– Property value appreciation over time

– Tax advantages, including deductions for mortgage interest and property depreciation

– Portfolio diversification to reduce risk

Successful real estate investors, like Donald Trump and Barbara Corcoran, have built wealth through strategic property acquisitions, renovations, and smart investment decisions.

Types of Real Estate Investments

- Rental properties: Owning and renting out residential or commercial properties for monthly income.

- Fix-and-flip properties: Buying distressed properties, renovating them, and selling for a profit.

- Real estate investment trusts (REITs): Investing in publicly traded companies that own and manage real estate properties.

- Real estate crowdfunding: Pooling resources with other investors to fund real estate projects.

Types of Real Estate Investments

Investing in real estate offers a variety of options, each with its own risks and rewards. Let’s explore the different types of real estate investments and their potential benefits.

Residential Real Estate

Residential real estate involves properties used for living purposes, such as single-family homes, condos, and apartments. Investors can generate income through rental payments or property appreciation over time. For example, buying a multi-unit property and renting out individual units can provide a steady stream of rental income.

Commercial Real Estate

Commercial real estate includes properties used for business purposes, like office buildings, retail spaces, and warehouses. While commercial properties typically have higher upfront costs, they can yield higher returns. An example of a successful commercial real estate investment is purchasing an office building in a prime location and leasing out space to businesses for a profit.

Industrial Real Estate

Industrial real estate involves properties used for manufacturing, distribution, or storage, such as factories, warehouses, and distribution centers. Investing in industrial real estate can be lucrative due to long-term leases and stable cash flow. For instance, acquiring a warehouse in a busy logistics hub can result in consistent rental income from logistics companies.

Vacation Rental Properties

Vacation rental properties are short-term rental homes or apartments used by travelers on vacation. Investors can earn income through nightly or weekly rentals, especially in popular tourist destinations. An example of a successful vacation rental investment is purchasing a beachfront property and renting it out to vacationers during peak seasons.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across various sectors. Investors can buy shares of REITs like stocks, providing diversification and passive income. Investing in REITs allows individuals to access real estate markets without owning physical properties directly.

Real Estate Market Analysis

Investing in real estate can be a lucrative venture, but it’s crucial to conduct a thorough market analysis before diving in. Understanding the market trends and indicators can help you make informed decisions and increase the chances of a profitable investment.

Importance of Market Analysis

Market analysis allows you to assess the current state of the real estate market in a specific area. By analyzing factors such as supply and demand, property prices, rental rates, and economic indicators, you can determine the potential profitability of a real estate investment. This information is essential for identifying opportunities and risks, guiding your investment strategy, and maximizing returns.

Conducting a Market Analysis

To conduct a market analysis for potential real estate investments, start by researching local market data and trends. Look at historical sales data, current listings, and rental rates in the area. Consider factors like population growth, job market stability, and development projects that could impact property values. Utilize online tools, real estate reports, and local experts to gather comprehensive information about the market.

Interpreting Market Trends

When interpreting market trends and indicators, pay attention to key metrics such as average days on market, price-to-rent ratios, and vacancy rates. These metrics can provide insights into the demand for properties in a particular area and help you assess the potential profitability of an investment. Additionally, keep an eye on economic indicators like interest rates, inflation, and employment rates, as they can influence the overall health of the real estate market.

Financing Real Estate Investments

Real estate investments often require significant capital, and understanding the various financing options available is crucial for success in this field. From traditional mortgages to hard money loans, partnerships, and creative financing strategies, there are multiple ways to fund real estate ventures.

Traditional Mortgages, Real Estate Investing Tips

- Traditional mortgages are a common way to finance real estate investments, allowing investors to purchase properties with a down payment and repay the loan over time.

- Interest rates and terms for traditional mortgages are typically competitive, making them a popular choice for long-term investments.

Hard Money Loans

- Hard money loans are short-term, high-interest loans that are often used by real estate investors who need quick financing or have less-than-ideal credit.

- While hard money loans can be more expensive, they offer flexibility and speed that traditional lenders may not provide.

Partnerships

- Forming partnerships with other investors or real estate professionals can be a great way to access additional capital and expertise for larger projects.

- Partnerships can also help distribute risk and allow investors to leverage each other’s strengths in the investment process.

Creative Financing Strategies

- From seller financing to lease options and subject-to deals, creative financing strategies offer alternative ways to fund real estate investments without relying solely on traditional lenders.

- These strategies require careful negotiation and structuring but can provide unique opportunities for investors to acquire properties with minimal cash upfront.

Tips to Secure Financing

When seeking financing for real estate investments, consider the following tips:

- Improve your credit score to qualify for better loan terms and interest rates.

- Prepare a solid business plan and investment proposal to present to lenders or potential partners.

- Build relationships with local banks, credit unions, and private lenders to explore different financing options.

- Consider working with a real estate agent or broker who specializes in investment properties to access their network of lenders and investors.

Leveraging Financing for Maximum Returns

When used strategically, leveraging financing can amplify returns on real estate investments by allowing investors to control more properties with less of their own capital.

- By using leverage, investors can increase their buying power and diversify their portfolio without tying up all their funds in a single property.

- However, it’s crucial to manage leverage responsibly and be prepared for market fluctuations or changes in interest rates that can impact investment returns.

Real Estate Investment Strategies

Investing in real estate offers various strategies that cater to different goals and resources. Understanding the pros and cons of each strategy is crucial in making informed investment decisions.

Buy and Hold

- Investors purchase properties to hold onto for the long term, generating rental income.

- Pros: Passive income, potential for property appreciation over time, tax benefits.

- Cons: Requires ongoing property management, market fluctuations may affect rental income.

Fix and Flip

- Investors buy distressed properties, renovate them, and sell for a profit.

- Pros: Quick returns on investment, opportunity to increase property value through renovations.

- Cons: High upfront costs, market volatility can impact selling price, requires renovation expertise.

Wholesaling

- Investors act as intermediaries, securing properties at a discount and selling to other investors for a fee.

- Pros: Low capital requirement, no need for property ownership, quick transactions.

- Cons: Competitive market, legal complexities in some areas, requires strong negotiation skills.

Choosing the Right Strategy

- Consider your financial goals, risk tolerance, time commitment, and expertise before selecting an investment strategy.

- Assess the local real estate market and economic conditions to determine the most suitable approach.

- Seek advice from experienced investors or real estate professionals to gain insights and guidance.

Risk Management in Real Estate Investing: Real Estate Investing Tips

Investing in real estate comes with various risks that investors need to be aware of and prepared for. Understanding these risks and implementing strategies to mitigate them is crucial for long-term success in real estate investing.

Common Risks in Real Estate Investing

- Market Fluctuations: Real estate markets can be volatile, leading to fluctuations in property values.

- Vacancy Rates: High vacancy rates can impact rental income and cash flow.

- Interest Rate Risk: Changes in interest rates can affect financing costs and mortgage payments.

- Property Damage: Unexpected damages to properties can result in costly repairs.

Strategies for Mitigating Risks

- Perform Due Diligence: Thoroughly research properties and markets before making investment decisions.

- Diversification: Spread investments across different properties and locations to reduce exposure to risk.

- Insurance: Obtain adequate insurance coverage to protect against property damage and liability risks.

- Emergency Fund: Maintain a cash reserve to cover unexpected expenses and mitigate financial risks.

Importance of Diversification and Asset Protection

Diversification is key to reducing risk in real estate investing by spreading investments across different types of properties and locations. Asset protection strategies, such as forming LLCs or trusts, can help safeguard assets from potential liabilities. By diversifying and protecting assets, investors can better manage risks and enhance the long-term performance of their real estate portfolios.

Real Estate Tax Strategies

When it comes to real estate investing, understanding the tax implications and benefits is crucial for maximizing your profits and minimizing your liabilities. By implementing the right tax-saving strategies and proper planning, investors can take advantage of various incentives and deductions to optimize their returns.

Tax Benefits of Real Estate Investments

- Depreciation Deduction: Real estate investors can benefit from depreciation deductions, allowing them to deduct a portion of the property’s value over time.

- Mortgage Interest Deduction: Investors can deduct the interest paid on mortgages used to finance their real estate investments.

- Capital Gains Tax Benefits: Long-term capital gains from real estate investments are taxed at a lower rate compared to ordinary income.

Tax-Saving Strategies for Real Estate Investors

- 1031 Exchange: Utilize a 1031 exchange to defer capital gains taxes by reinvesting proceeds from the sale of one property into another similar property.

- Passive Activity Loss Rules: Take advantage of passive activity loss rules to offset income from real estate investments with losses from other passive activities.

- Proper Entity Structuring: Consider structuring your real estate investments through entities like LLCs or S-Corporations to optimize tax benefits and protect assets.

Maximizing Tax Advantages through Planning and Structuring

- Keep Detailed Records: Maintain accurate records of expenses, income, and deductions related to your real estate investments to maximize tax advantages.

- Consult with Tax Professionals: Work with tax professionals who specialize in real estate to ensure you are taking full advantage of available tax benefits and incentives.

- Stay Informed on Tax Laws: Stay up to date on changes in tax laws and regulations that may impact your real estate investments, allowing you to adapt your strategies accordingly.

Real Estate Market Trends

In the ever-evolving landscape of real estate investing, staying up-to-date with market trends is crucial for making informed investment decisions. By analyzing current trends, investors can anticipate changes and adjust their strategies accordingly.

Impact of Market Trends on Real Estate Investments

- Market trends can influence property values, rental rates, and demand for certain types of properties.

- Understanding market trends can help investors identify emerging opportunities and potential risks in different market segments.

- Changes in market trends, such as shifts in demand or supply, can impact the profitability of real estate investments.

Staying Updated with Market Trends

- Regularly follow industry publications, reports, and market analysis to stay informed about the latest trends.

- Utilize online tools and platforms that provide real-time data and insights on market trends in specific locations.

- Attend real estate conferences, seminars, and networking events to connect with industry experts and gain valuable insights.

Yo, listen up fam! When it comes to securing that bag and building a solid future, it’s all about having a dope savings plan in place. Check out this article on Building a Savings Plan to get the 411 on how to stack that paper and make it rain in the long run. Don’t sleep on your financial future, start planning now!

Yo, peeps! Let’s talk about how to start building a savings plan for your future. Check out this dope article on Building a Savings Plan that has some killer tips on how to save that cash money. It’s important to start early and stay consistent, so you can secure that bag and live your best life. Don’t sleep on your financial future, fam!