Real Estate Investment Tips: Looking to dive into the world of real estate investment? Get ready to uncover the secrets to success in this lucrative industry.

From understanding different types of investments to evaluating key factors before diving in, this guide has got you covered with all the essential tips you need to know.

Importance of Real Estate Investment

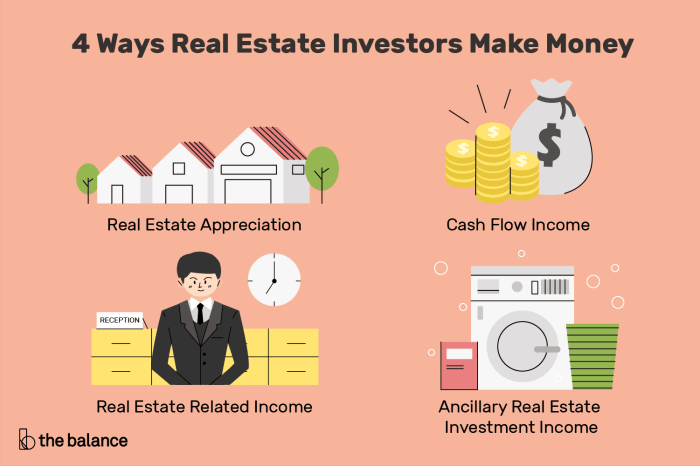

Investing in real estate is a popular choice for many investors due to its potential for long-term growth and financial stability. Real estate offers a variety of benefits that make it an attractive investment option.

Benefits of Investing in Real Estate

- Diversification: Real estate can help diversify an investment portfolio, reducing overall risk.

- Tax Advantages: Investors can benefit from tax deductions, depreciation, and potentially lower tax rates on long-term capital gains.

- Appreciation: Real estate properties have the potential to increase in value over time, providing a source of wealth accumulation.

- Passive Income: Rental properties can generate passive income through regular rental payments, offering a steady cash flow.

Real Estate as a Wealth-Building Strategy

Real estate investment can be a powerful wealth-building strategy over the long term. By leveraging the power of compounding growth and rental income, investors can build equity and generate wealth through their real estate holdings.

Passive Income from Real Estate Investment

- Rental Properties: Owning rental properties can provide a consistent source of passive income through rental payments from tenants.

- Real Estate Investment Trusts (REITs): Investing in REITs allows investors to earn passive income through dividends without the need to manage properties directly.

Types of Real Estate Investments

When it comes to real estate investments, there are various types that investors can consider. The two main categories are residential and commercial real estate investments, each with its own set of risks and rewards. In addition, modern options like real estate crowdfunding and alternative investment opportunities have also emerged in recent years.

Yo, check it out for some dope Meal Prep Ideas that will keep you on top of your game. Whether you’re hustlin’ at school or grindin’ at work, having your meals prepped and ready to go can save you time and money. From simple recipes to budget-friendly options, these meal prep ideas got your back, fam. Stay fresh, stay healthy!

Residential vs. Commercial Real Estate Investments

Residential real estate investments involve properties used for living purposes, such as single-family homes, apartments, or condominiums. On the other hand, commercial real estate investments include properties used for business purposes, like office buildings, retail spaces, or industrial complexes.

- Risks and Rewards:

- Residential real estate investments tend to be more stable and predictable, with steady rental income from tenants. However, they may be affected by economic downturns or changes in the housing market.

- Commercial real estate investments can offer higher returns but come with higher risks. They are subject to market fluctuations, lease negotiations, and tenant turnover.

Real Estate Crowdfunding

Real estate crowdfunding is a modern investment option that allows investors to pool their resources and invest in properties through online platforms. This method provides access to real estate projects with lower capital requirements and greater diversification.

Yo, check it out – if you’re looking for some dope Meal Prep Ideas that will keep you fueled up and ready to tackle the day, you gotta peep this link: Meal Prep Ideas. Get some fresh inspo and level up your meal prep game, straight up!

- Benefits:

- Increased access to real estate investments for individual investors.

- Diversification across multiple properties and locations.

- Potential for passive income and capital appreciation.

Alternative Real Estate Investment Opportunities

Aside from traditional residential and commercial properties, there are other alternative real estate investment opportunities that investors can explore:

- Real Estate Investment Trusts (REITs): Publicly traded companies that own, operate, or finance income-producing real estate across various sectors.

- Real Estate Limited Partnerships (RELPs): Investment structures where investors contribute capital to a real estate project managed by a general partner.

- Real Estate Syndications: Group investments in real estate deals led by a sponsor or syndicator.

Factors to Consider Before Investing

Investing in real estate can be a lucrative venture, but it’s essential to consider several key factors before diving in. By evaluating these factors, you can make informed decisions and increase your chances of success in the real estate market.

Importance of Location

When investing in real estate, location is crucial. A property’s location can significantly impact its value and potential for growth. Factors to consider include proximity to amenities, schools, transportation, and overall neighborhood desirability.

Market Trends

Understanding current market trends is essential for successful real estate investments. Analyze factors such as supply and demand, pricing trends, and economic indicators to gauge the market’s stability and growth potential.

Property Condition

The condition of a property can affect its value and profitability. Conduct thorough inspections to assess the property’s structural integrity, maintenance needs, and potential for renovations or upgrades. This will help you determine the overall cost of ownership and potential return on investment.

Thorough Due Diligence

Before making a purchase, it’s crucial to conduct thorough due diligence. This includes researching the property’s history, reviewing financial records, and verifying legal documentation. By performing due diligence, you can uncover any potential issues or risks associated with the property.

Assessing ROI

Calculating the potential return on investment (ROI) is essential for evaluating the profitability of a real estate property. Consider factors such as rental income, property appreciation, and expenses to determine the expected ROI. This will help you make informed decisions and maximize your investment returns.

Financing and Investment Strategies: Real Estate Investment Tips

When it comes to real estate investments, understanding the different financing options available is crucial. From traditional loans to creative strategies, choosing the right financing method can greatly impact the success of your investment journey.

Financing Options, Real Estate Investment Tips

- Traditional Mortgages: This is the most common way to finance a real estate investment, where you borrow money from a bank or lender and repay it over time with interest.

- Hard Money Loans: These are short-term, high-interest loans often used by real estate investors who need quick financing or have poor credit.

- Private Money Lenders: Individuals or private companies that provide loans for real estate investments, offering more flexibility than traditional lenders.

Leveraging Strategies

- Using Other People’s Money (OPM): Leveraging OPM involves using someone else’s funds to finance your real estate investment, reducing your own capital at risk while potentially increasing returns.

- Joint Ventures: Partnering with other investors to pool resources and expertise, sharing the risks and rewards of the investment.

- Seller Financing: This involves the seller acting as the lender, allowing the buyer to make payments directly to them instead of a traditional financial institution.

Choosing the Right Strategy

- Consider Your Financial Goals: Whether your goal is short-term profit or long-term wealth building, choose a financing and investment strategy that aligns with your objectives.

- Evaluate Risk Tolerance: Assess how much risk you are willing to take on and choose a strategy that matches your comfort level with uncertainty and potential losses.

- Seek Professional Advice: Consult with a financial advisor or real estate expert to determine the best financing and investment strategy based on your individual circumstances.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investors can buy shares in a REIT, providing them with exposure to real estate without the need to directly own properties. REITs offer diversification, liquidity, and potential dividends, making them a popular choice for investors looking to add real estate to their portfolio.